« MS Access vs Excel vs Datamartist | Self Serve Business Intelligence »

Being led astray by numbers

Hindsight is oh so clear, but the recent (ongoing?) meltdown of the credit market still amazes me. There is a good article in Wired this month, talking about some of the math that led everyone astray.

In the end, there is a lesson for data analysts in all this too;

- Do not believe the numbers just because they are telling you want you want to hear.

- If you go looking for something, you can trick yourself into finding it.

- Don’t assume just because everyone else is doing something, that it’s a good idea, or it works for your situation.

Managers at the banks went looking for profits and ways to expand their business. They had systems in place that would only tolerate a certain amount of risk, but they basically talked themselves into believing the risk had gone somewhere. It seems to me that the more of them that started using this new system and “new math” the more comfortable they all felt. After all, if the Pros at Citi bank, and AIG, and Lehman’s are all using it, it must be valid, right?

What’s amazing of course, is that no one asked the obvious question- “How can this investment be AAA when there is nothing but junk in it?” In fact, I am sure they did ask, and got the answer “yes, but they can’t all go bad at once- we’ve proven that with our Gaussian copula function– see?”.

But the models were historically based. Which is great, because historical data is easier to get than data from the future. But it does bring into question your assumptions. In this case the assumption history was creating was “Housing prices will keep rising forever.”

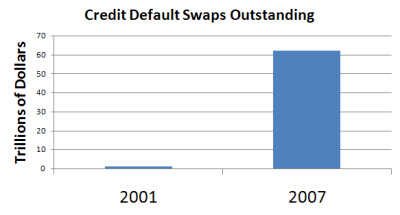

It’s obvious from the growth between 2001 and 2007 that everyone was getting on the bus:

The other amazing thing was that almost everyone had the same model. Mono-cultures are a bad idea- the tragedy of the Irish Famine in the mid 19th century had many facets, but one of the key ones was the fact that every potato in the country was a clone of all the others. When one potato gets sick, they all get sick. When one bank has a problem… I leave you with a quote (one of thousands) that comes up when you google “Credit Default Swaps”- this was some sage advice from an expert in 2006-

CDS transactions continue to provide a unique method for buyers and sellers to strategically isolate credit exposure to specific reference entities and for obligations in a fast, efficient manner that avoids the shortcomings of the cash markets by eliminating interest rate, asset availability and funding concerns.

What they failed to mention, is that it also avoids any contact with reality.

« MS Access vs Excel vs Datamartist | Self Serve Business Intelligence »